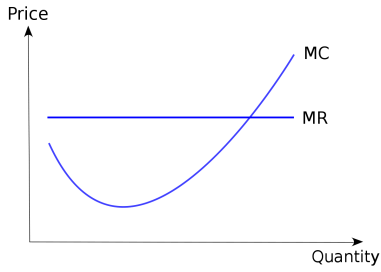

MR=MC refers to the profit maximization principle in economics where marginal revenue generated from additional production equals marginal cost expended in the production. However, I believe that the principle extends well outside the realm of maximizing a company’s profits. People and organizations put in the efforts to achieve something that they view as worthy of their efforts. Only if the results turn out to be above their expectations, they continue their efforts.

In this sense, MR=MC can function as the principle through which we can understand the world, the markets, and the players. In markets, prices move in tandem with expectations, and these expectations are set by players with their own MR=MC conditions. In politics, sovereigns and states move with strategic goals in mind, and their efforts are expended to optimize for their own MR=MC condition.

This blog will examine MR=MC equilibrium conditions across the world with a special focus on private capital investing, answering the following question:

“How can you deploy capital in a meaningful manner in today’s world?”

There are two parts to the question: 1) deploying capital in a meaningful manner, and 2) today’s world. The former involves a discussion on asset classes and business models, while the latter involves a discussion on macroeconomic trends, and technology. A recognition of these two separate discussions is why the blog’s subtitle is “Investing private capital in a global macro world”

So it begins! I hope you all enjoy the blog.